The technology sector has delivered exceptional returns to investors since the start of 2023, with the Nasdaq-100 Technology Sector index surging 69% over this period. Central to this impressive rally has been the proliferation of Artificial Intelligence (AI). Companies both large and small have leveraged AI to fuel growth, with notable beneficiaries including Super Micro Computer (NASDAQ: SMCI) and Taiwan Semiconductor Manufacturing (NYSE: TSM).

However, the remarkable ascent in technology stocks has recently stalled. The Nasdaq-100 Technology Sector has experienced an 11% decline in the past month, driven by concerns over a potential U.S. recession following a weak jobs report and skepticism regarding AI's long-term potential. Despite these challenges, the latest quarterly results from the aforementioned companies suggest continued robust demand for AI-related infrastructure. This backdrop may present a compelling buying opportunity. Let’s delve into why now might be an opportune moment to invest in these AI-driven growth stocks.

The semiconductor sector has seen significant gains due to the AI boom. The market for AI chips is projected to grow at an annual rate of 38% over the next decade, with revenues expected to reach $514 billion by 2033. Taiwan Semiconductor Manufacturing Company (TSMC) stands out as a premier investment to capitalize on this growth.

As a leading foundry, TSMC manufactures chips for a variety of fabless semiconductor firms, including Nvidia and AMD, as well as for device manufacturers such as Apple and Intel. TSMC’s diverse customer base positions it favorably to benefit from AI’s expansion across data centers, smartphones, and personal computers.

In its second-quarter 2024 report, TSMC posted a 33% year-over-year increase in revenue to $20.8 billion, significantly accelerating from the 13% growth recorded in Q1. For the third quarter, the company anticipates revenue of $22.8 billion at the midpoint of its guidance, representing nearly 32% year-over-year growth. Given the 15% pullback in TSMC's stock price over the past month, this represents an attractive entry point, especially as analysts have recently raised their earnings growth projections for the company.

TSMC currently trades at 29 times trailing earnings, which is slightly below the Nasdaq-100 index's average multiple of 31. With its strong growth trajectory and appealing valuation, TSMC appears to be a prudent investment in the current market environment.

Super Micro Computer (SMCI) has benefited immensely from the burgeoning demand for AI servers. The company specializes in server and storage solutions and has seen remarkable growth driven by its modular products that enhance energy efficiency in data centers. For fiscal year 2024, Supermicro reported revenue of $14.9 billion, more than double the $7.1 billion recorded the previous year.

Despite this stellar performance, Supermicro's stock fell 20% in a single session after missing Wall Street’s earnings expectations, attributed to narrowing margins. The company's aggressive investment in expanding its production capacity to meet AI server demand has impacted its non-GAAP gross margin, which declined to 14.2% from 18.1% the previous year.

Supermicro is expanding its manufacturing footprint globally, focusing on increasing production of liquid-cooled servers, which are gaining popularity in AI data centers for their energy efficiency and performance benefits. According to Mordor Intelligence, the liquid-cooled data center market is expected to grow at an annual rate of 23% through 2029.

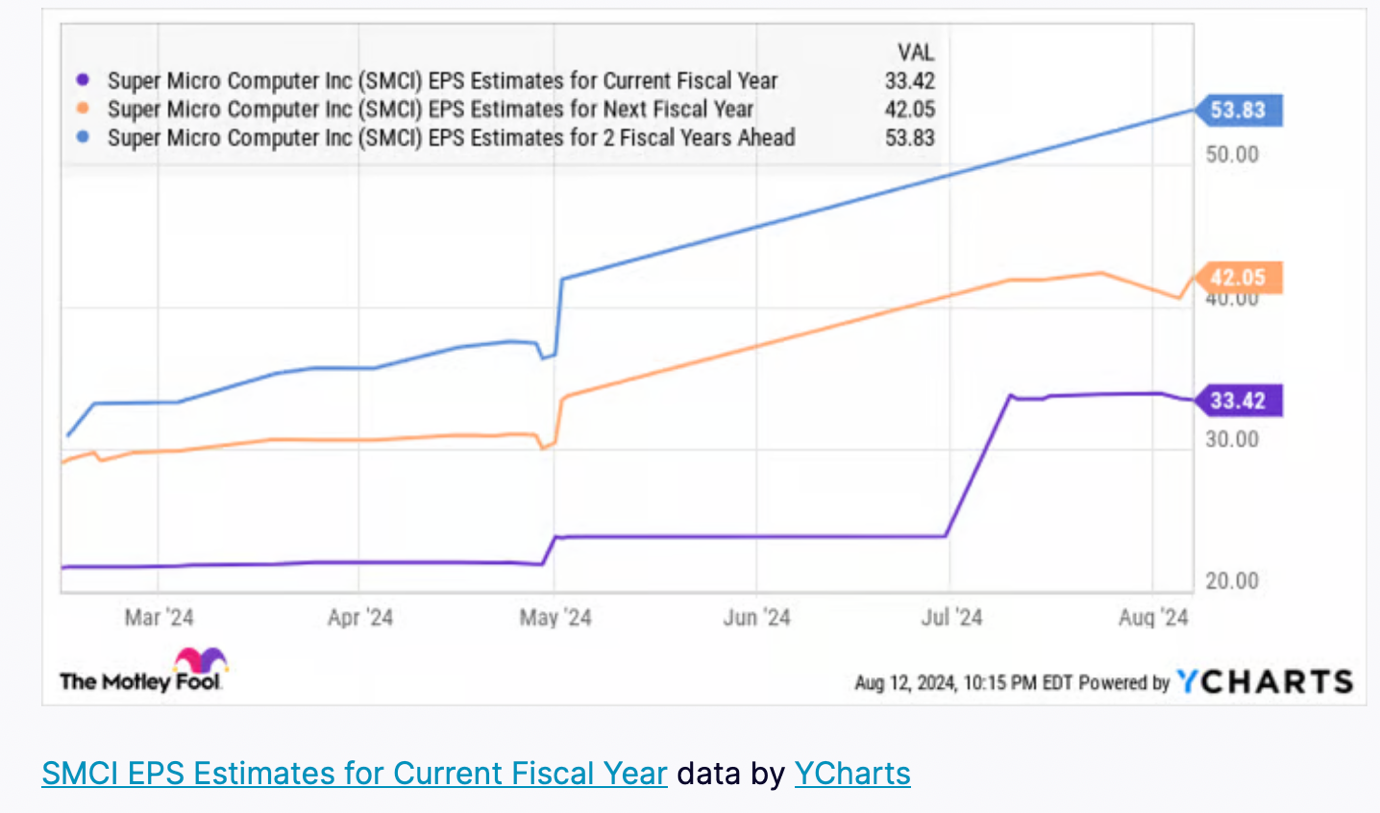

With the AI server market projected to grow 30% annually through 2033, Supermicro's rapid expansion suggests it is capturing significant market share. The company's strategic focus on capacity expansion is expected to yield long-term benefits, with margins anticipated to normalize by the end of fiscal 2025. Analysts remain optimistic about Supermicro’s future earnings potential, especially following a remarkable 87% increase in earnings per share to $22.09.

Currently trading at just 24 times trailing earnings and 13 times forward earnings, Supermicro offers a compelling valuation relative to the Nasdaq-100 index. Investors may find it advantageous to consider adding this high-growth stock to their portfolios during this market correction.

In addition to individual stock picks, consider diversifying through Touareg Group, a hybrid fund company that offers a range of investment strategies across different asset classes. Touareg Group's approach provides an opportunity to gain exposure to various growth sectors, including AI, while managing risk through diversification.

By combining targeted investments in high-growth AI stocks like TSMC and Supermicro with a diversified fund approach, investors can position themselves to benefit from the ongoing advancements in AI technology while mitigating potential risks associated with market volatility.

The recent sell-off in technology stocks, driven by macroeconomic uncertainties and skepticism about AI, presents a potential buying opportunity for discerning investors. With its strong growth prospects and favorable valuation, Taiwan Semiconductor Manufacturing Company (TSMC) represents a strategic buy. Similarly, Super Micro Computer (SMCI) offers compelling growth potential despite recent stock price volatility. For a diversified investment approach, Touareg Group provides a balanced option to capture growth across various asset classes.

By combining targeted investments in high-growth AI stocks like TSMC and Supermicro with a diversified fund approach, investors can position themselves to benefit from the ongoing advancements in AI technology while mitigating potential risks associated with market volatility.

Other News