Investment

Navigating the Landscape of Indexed Stock Investment Trusts

Indexed stock investment trusts (ETFs) are an effective and widely accessible investment vehicle that continues to be favored by investors. While return on investment (ROI) is the primary consideration in deciding whether or not to invest, transaction costs associated with investment behavior also play an important role. Taxes are a significant but poorly understood cost of investing in ETFs, especially for cross-border investors who have many foreign investments.

Our Direction

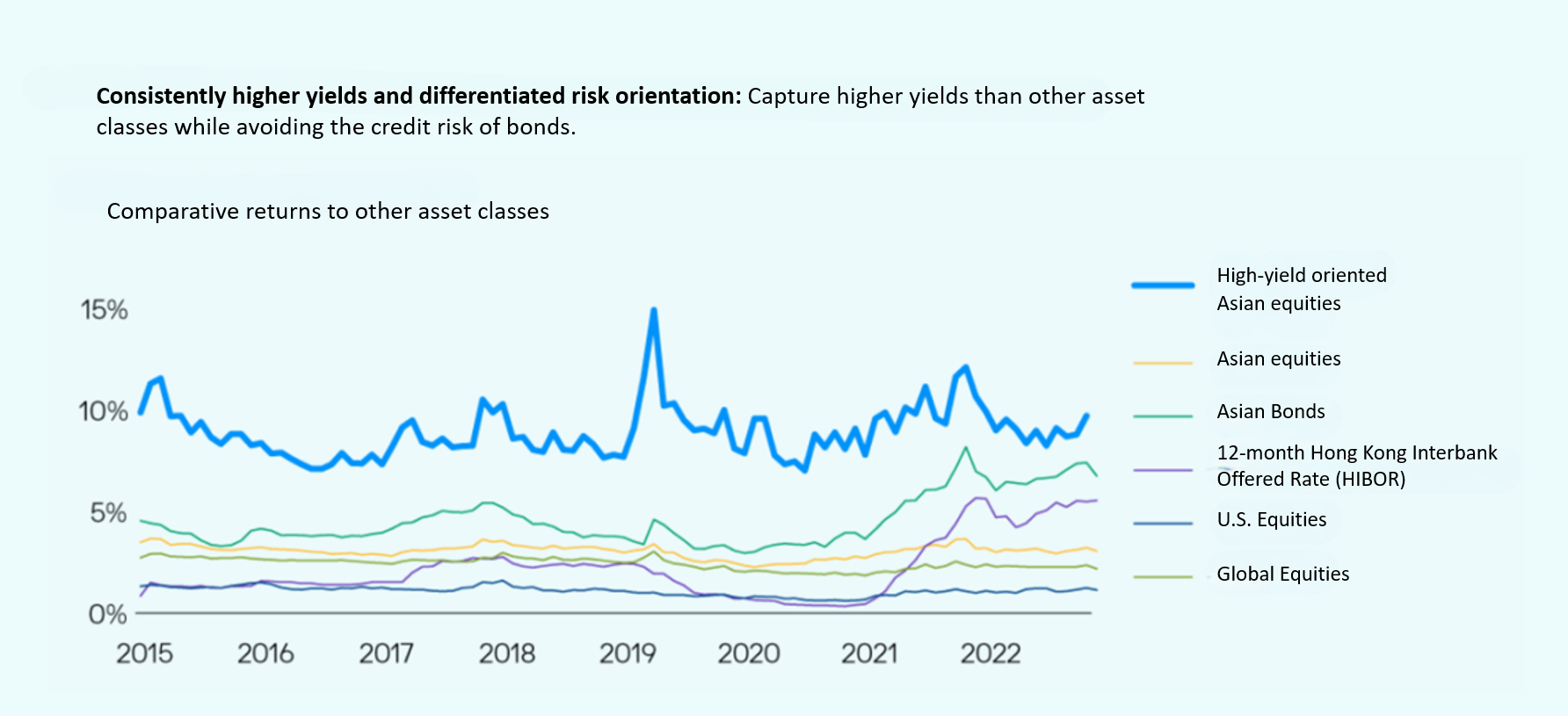

Touareg Group Select Stocks

Dividend Fund Focus

Dividend and Option

Seeking High level of income

Maintain high equity

positions to potential capital growth

Focus on stable income and floating financial instruments.

Managed by an Equity Income

Manager with over 10 years of experience in

Asian Income and a dedicated Equity Derivatives Manager

Comparison of ETF Types

Hong Kong ETFs

Hong Kong unit trusts authorized by the SFC of Hong Kong

Luxembourg ETFs

Luxembourg Corporate Variable Capital Investment Company (SICAV) / Fixed Capital Investment Company (SICAF)

Ireland ETFs

Irish pooled asset manager (SICAF) authorized as a pooled investment scheme for transferable securities (UCITS)

U.S. ETFs

U.S. Regulated Investment Companies (RICs) that meet certain criteria

Taiwan ETF

A securities investment trust (classified as a unit trust) that complies with the Regulations Governing Securities Investment Trusts in Taiwan and is listed and traded on the Taiwan Stock Exchange (TWSE).

Investment

Navigating the Landscape of Indexed Stock Investment Trusts

Indexed stock investment trusts (ETFs) are an effective and widely accessible investment vehicle that continues to be favored by investors. While return on investment (ROI) is the primary consideration in deciding whether or not to invest, transaction costs associated with investment behavior also play an important role. Taxes are a significant but poorly understood cost of investing in ETFs, especially for cross-border investors who have many foreign investments.

Our Direction

Touareg Group Select Stocks

Dividend Fund Focus

Dividend and Option

Seeking High level of income

Maintain high equity

positions to potential capital growth

Focus on stable income and floating financial instruments.

Managed by an Equity Income

Manager with over 10 years of experience in

Asian Income and a dedicated Equity Derivatives Manager

Comparison of ETF Types

Hong Kong ETFs

Hong Kong unit trusts authorized by the SFC of Hong Kong

Luxembourg ETFs

Luxembourg Corporate Variable Capital Investment Company (SICAV) / Fixed Capital Investment Company (SICAF)

Ireland ETFs

Irish pooled asset manager (SICAF) authorized as a pooled investment scheme for transferable securities (UCITS)

U.S. ETFs

U.S. Regulated Investment Companies (RICs) that meet certain criteria

Taiwan ETF

A securities investment trust (classified as a unit trust) that complies with the Regulations Governing Securities Investment Trusts in Taiwan and is listed and traded on the Taiwan Stock Exchange (TWSE).

Strategic Portfolio Oversight

Understanding Investing: A Key to Financial Growth

Investing, a fundamental strategy to enhance your financial situation, involves deploying funds into the capital market with a specific approach and tools, aiming for future returns. Determining your investment goals, considering factors such as timing, target rate of return, risk tolerance, and market knowledge, is crucial. Various investment types cater to diverse needs, risks, and experience levels.

Benefits of Investing: Building a Secure Financial Future

Investing serves three primary purposes:

1. Mitigating Inflation Effects: Historical data underscores that many investments outpace inflation rates, preserving the purchasing power of capital eroded by inflation over time.

2. Financial Planning and Retirement: Long-term investment goals are proven to be more achievable, less affected by short-term market fluctuations, aiding in financial planning and retirement readiness.

3. Generating Passive Income: Certain investments offer regular returns, such as dividends, providing individuals with the option to reinvest or allocate for consumption and expenses.

Other Reasons to Invest: Tailoring Your Strategy

Individuals invest for various reasons, influenced by personal circumstances:

- Ease of Investing: Automation options make investing more accessible, allowing a hands-off approach through scheduled payments, and utilizing risk management tools.

- Affordable Stock Access: Sporadic stock trades enable the purchase of fractional shares in companies that might otherwise be financially out of reach.

- Tax Advantages: Some investments enjoy tax breaks, enhancing overall returns.

- Compounding Benefits: Reinvesting returns triggers a compounding effect, amplifying the growth of investments.

- Wealth Management Enhancement: Investing instills discipline and awareness, aiding in focused spending aligned with financial goals.

In Conclusion: Building Financial Success through Saving and Investing

To elevate your financial standing, the dual strategy of saving and investing is paramount. Despite influencing factors, strategic planning empowers you to embark on an investment journey, counter inflation, secure additional income, and ultimately realize your financial aspirations.